Wealth Weekly #13

Bitcoin Halving After-Glow: The Cycle Most People Miss

Hook

What if the biggest wealth event of 2026 already happened — and almost nobody noticed?

Every four years, Bitcoin quietly resets its supply schedule — and history shows fortunes are built in the 18 months after.

We’re in that window right now.

1️⃣ Understanding the Halving

Bitcoin runs on code — no CEO, no central bank.

That code cuts the reward miners earn in half every 210,000 blocks (about four years).

Result: new coins enter the market 50 % slower, but demand rarely drops as fast.

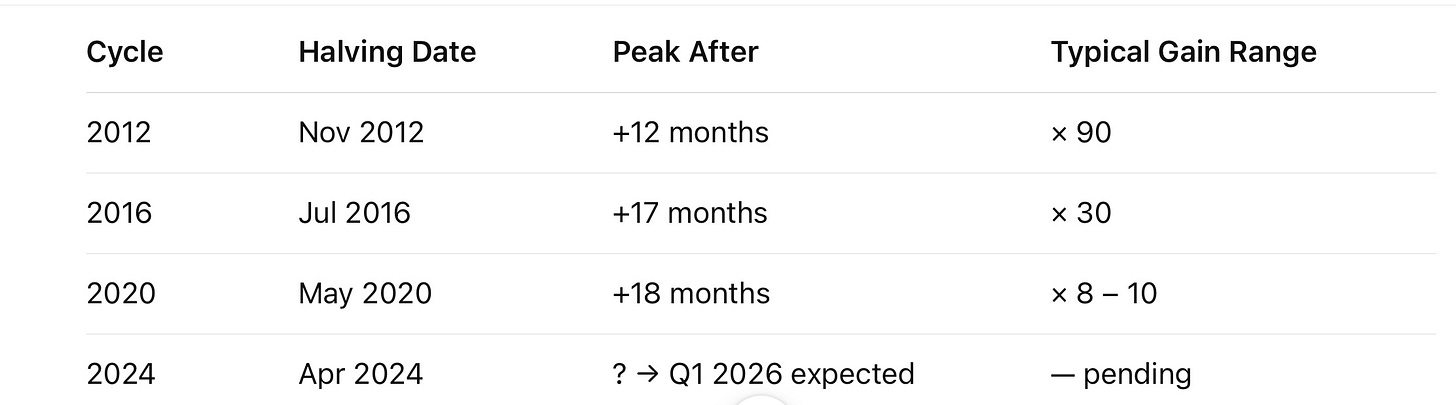

Past cycles prove the pattern:

2️⃣ Why It Matters Now

We’re currently in the “after-glow” stage — the quiet accumulation phase before the media returns.

ETFs & Institutions: BlackRock, Fidelity and others now hold billions in Bitcoin for clients.

Retail Fatigue: Casual investors moved on = better entry prices for those paying attention.

Macro Shift: Interest-rate cuts + weaker dollar often ignite risk assets like crypto.

History doesn’t repeat exactly — but it rhymes on blockchain.

3️⃣ Realistic Return Outlook

Short term (End 2025): Potential 10–30 % climb as liquidity returns.

Mid term (Q1–Q3 2026): Historically 100 % + runs have followed every halving cycle.

Long term (2028 cycle): Ongoing ETF buy-pressure may create multi-year compounding.

These aren’t promises — they’re probabilities based on transparent supply math.

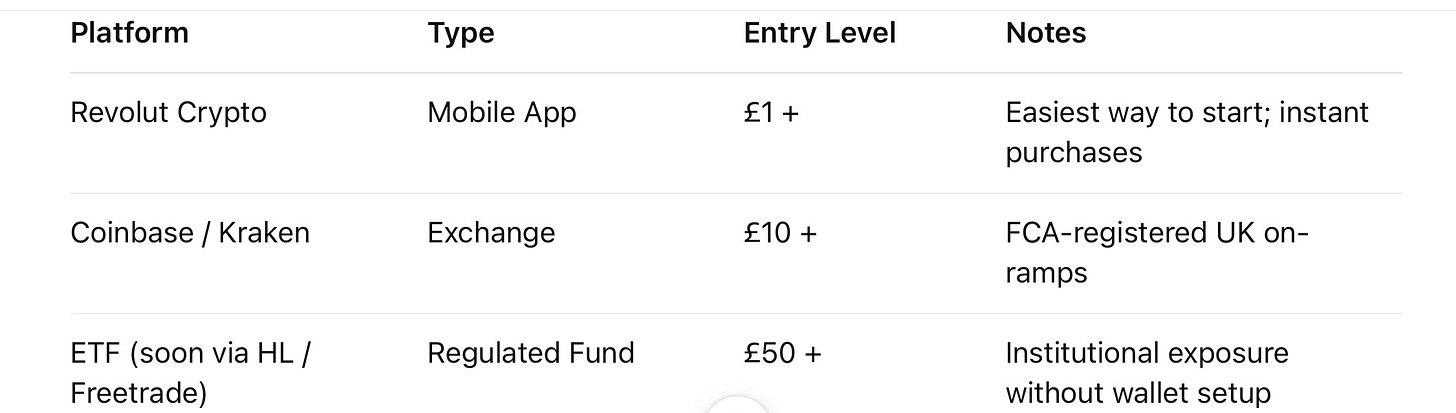

4️⃣ Where to Invest Safely

Keep it simple and regulated for UK readers:

Advanced holders can store offline (Ledger Nano X) for long-term security.

5️⃣ The Risks

Volatility: 20 % price swings in a week are normal.

Regulation: UK & EU rules tightening in 2026 could affect access.

Liquidity timing: Selling too early often misses cycle peaks.

Scams: Never trust WhatsApp “traders” or unverified apps — use known platforms only.

At TSWB, we teach both reward and risk — so you act with confidence, not FOMO.

6️⃣ Smart Starter Strategy

Allocate max 5–10 % of portfolio to crypto.

Automate small weekly buys (“DCA” method).

Set calendar alerts every 90 days to review progress.

Withdraw profits once you’ve doubled your initial stake — let the rest ride risk-free.

“It’s not about catching the top; it’s about owning a piece of the future early.”

📘 Word of the Week: Halving

Definition:

A programmed event that reduces Bitcoin’s new supply by 50 %, occurring roughly every four years.

Simple Meaning:

“Fewer new Bitcoins enter the world — so existing ones can rise in value.”

🔮 Prediction

Institutional ETFs will accumulate over 50 % of newly minted Bitcoin by Q1 2026, creating a true supply crunch rally.

🚀 Bold Prediction

By mid-2026, Bitcoin will briefly overtake gold as the most searched investment term worldwide — triggering a new wave of mainstream interest.

Final Message

Cycles create patterns — discipline creates profits.

While the crowd waits for news headlines, the smart money quietly positions months in advance.

This halving after-glow is where knowledge meets timing.

Stay early. Stay informed. Stay invested.

— The Simple Wealth Blueprint

Thank you, Hina! 🙏 I’m really glad you found it valuable — more insights like this drop every Sunday. Appreciate you taking the time to read!

New idea of investment